I recently sat down with a founder, "Sarah," who proudly slid a board deck across the table. Slide 4 showed a Customer Acquisition Cost (CAC) Payback period of 9 months. In the world of B2B SaaS, that is exceptional. It implies that for every dollar she burns on sales and marketing, she gets it back in under a year. By all accounts, she should be pressing the accelerator.

But her bank account told a different story. Despite this "efficient" growth, the company was burning cash faster than revenue was coming in, and the runway was shrinking. The math didn't add up.

We popped the hood on the calculation, and within an hour, we found the leak. Sarah was falling victim to the two most common lies in unit economics: Blended CAC and Revenue-Based Payback.

Her "9-month" payback was an average. It blended highly efficient inbound organic leads (which cost nearly zero) with a bloated, ineffective paid performance channel that had a payback period of 26 months. Worse, she was calculating payback based on Revenue, not Gross Margin. She was assuming 100% of every dollar went to paying back the acquisition cost, ignoring the 30 cents on the dollar required to actually serve the software.

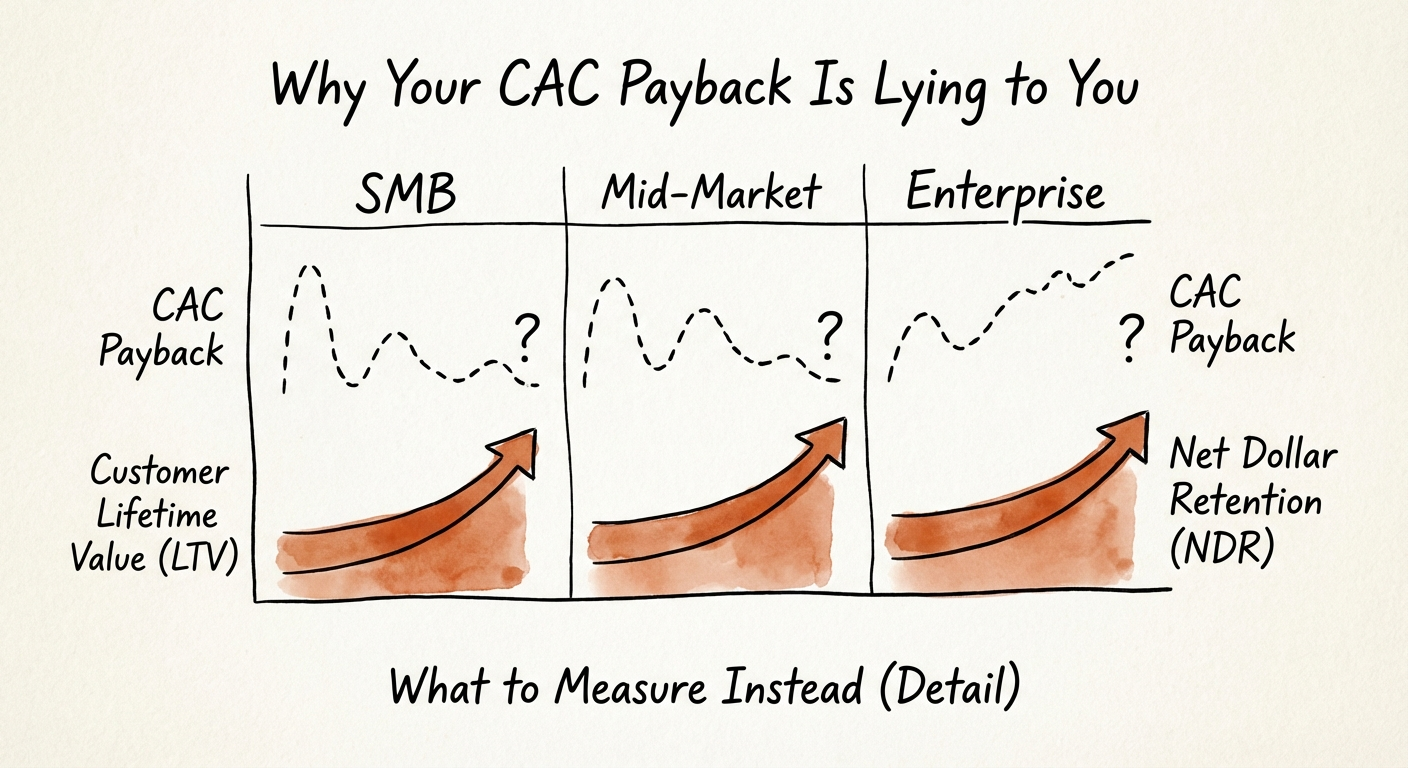

When we recalculated using the Gross Margin Adjusted Payback on her paid channels specifically, the number jumped from 9 months to 34 months. She wasn't scaling efficiency; she was scaling a cash hole. This isn't just Sarah's problem. 2025 benchmarks show that while the median payback is 15 months, the gap between "reported" payback and "real" cash recovery is widening.

Before we fix your formula, let's look at where the market actually stands. According to SaaS Capital's 2025 B2B SaaS Retention Benchmarks, the median CAC Payback Period for private B2B SaaS companies has settled at roughly 15 months. However, this varies wildly by contract value:

If you are in the Mid-Market range and seeing 9 months, you are either top 5% (unlikely without viral PLG) or you are measuring it wrong. The ICONIQ Growth State of Software 2025 report reinforces this, noting that while AI-native companies are scaling 2-3x faster, traditional SaaS efficiency is stabilizing around these 15-month norms.

Most founders calculate Payback as:

(Sales + Marketing Costs) / (New MRR Added)

This is dangerous. It tells you how long it takes to recover the revenue, not the profit. You cannot pay salaries with revenue that is already earmarked for AWS bills and Customer Success teams. You must use Gross Margin Adjusted Payback:

CAC Payback = (Sales + Marketing Expenses) / (New MRR × Gross Margin %)

If your Gross Margin is 70%, your "9-month" payback instantly becomes nearly 13 months (9 / 0.70). That is a 43% increase in the time your cash is locked up.

Furthermore, you must audit your "Load." Are you including:

See CAC Payback Benchmarks for Series B SaaS: The New Efficiency Standard for a deeper dive on what "good" looks like at your specific stage.

You cannot manage what you blend. To fix your unit economics and regain trust with your board (and your bank account), execute this three-step diagnostic immediately.

Stop reporting a single "Company Payback" number. Break it down by channel and segment. You likely have a "Barbell Distribution":

If you pour money into the "Outbound" bucket expecting the "Blended" result, you will burn out. You need to know the marginal CAC of the next customer, not the average of the last 100.

Is your Gross Margin really 80%? Or is it 65% because you haven't factored in the Customer Support team? Every percentage point of margin error compounds your payback timeline. As discussed in The New Rule of 40: Why Median SaaS Firms Are Trading at a Discount, efficiency is the primary valuation driver in 2025. Precision here matters.

Finally, calculate your Time to Cash Recovery. If your payback is 12 months, but you have Net 60 payment terms and a 3-month sales ramp, your cash out the door might not return for 16+ months. Ensure your CFO models this liquidity gap. For help on presenting this to stakeholders, refer to The CFO's Guide to SaaS Metrics for Board Reporting.

The Bottom Line: A 9-month vanity payback period is a great way to raise a Series A. A 15-month, gross-margin-adjusted, fully-loaded payback period is how you survive to Series C. Stop lying to yourself with averages. The truth is in the margins.