There is a specific moment in every scaling company’s life, usually between $10M and $20M ARR, where the graph stops pointing up and to the right. It doesn't flatline because the product failed. It doesn't flatline because the market evaporated. It flatlines because the CEO is still acting like a Founder.

In the early days ($0 to $5M), your success was defined by heroics. You closed the first ten deals. You wrote the core code. You personally onboarded the key accounts. You were the ‘Chief Everything Officer,’ and your sheer force of will was the only thing keeping entropy at bay. This behavior wasn't just necessary; it was celebrated.

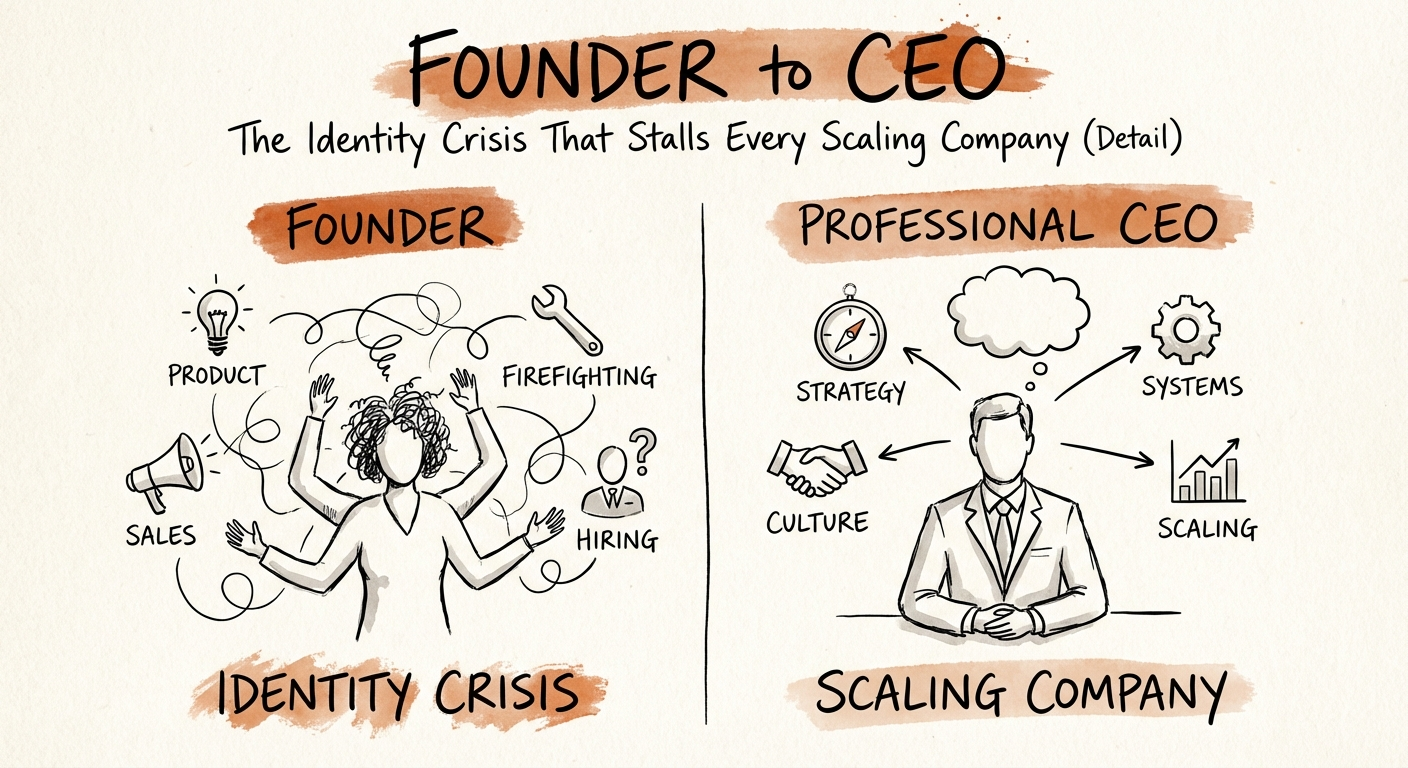

But as you cross the Series B threshold, that same ‘hero mode’ becomes a lethal bottleneck. I call this the Identity Crisis. You are intellectually aware that you need to delegate, but emotionally, you are terrified that if you take your hands off the wheel, the car will crash. So you hover. You ‘swoop and poop’ on projects. You become the ‘Super-VP of Sales’ instead of the CEO.

The result is a stalled organization. Your VPs get frustrated because they have no autonomy. Your calendar is a disaster of tactical firefighting. And deep down, you feel exhausted because you are trying to scale a company using sheer effort rather than systems. You are fighting a war with a knife when you should be commanding an aircraft carrier.

This isn't just a psychological hurdle; it is a statistical probability. According to Noam Wasserman’s research in The Founder’s Dilemmas, 52% of founders are replaced by Series C. Even more telling, 73% of those replacements are ‘founder firings’ initiated by the board. Why? Because the skills required to start a company (0 to 1) are diametrically opposed to the skills required to scale one (1 to n).

Wasserman frames this as the choice between being ‘Rich’ or ‘King.’ Founders who hold onto total control (‘King’) end up with significantly smaller companies. Founders who give up operational control to build a scalable executive team (‘Rich’) end up with a smaller slice of a much larger pie—often 2x to 3x more valuable in absolute terms.

If you plan to exit, this identity crisis has a literal price tag. In Private Equity due diligence, we look for Key Person Risk. If you are the only one who can close the big deals or the only one who understands the product roadmap, buyers will apply a ‘Key Person Discount’ to your valuation.

We see this constantly in our Founder Extraction Playbook engagements. The founder thinks they are protecting quality by staying involved. In reality, they are capping growth.

You cannot simply ‘decide’ to be a CEO. You must engineer the transition. Here is the framework we use to extract founders from the weeds without crashing the business:

Stop doing what you are ‘good’ at. Most founders are ‘good’ at sales, so they stay in sales. But your Zone of Genius is likely product vision or market strategy. Audit your last 2 weeks: categorize every hour as ‘CEO Work’ (Strategy, Hiring, Capital Allocation) or ‘Founder Work’ (Sales Calls, Code Reviews). If CEO Work is under 50%, you are in the danger zone.

Tribal knowledge is the enemy of equity value. You must aggressively document your decision-making heuristics, not just your tasks. See our guide on converting tribal knowledge to turnkey systems. If you can't explain how you make a decision, you can't delegate it.

When you hire a VP, do not ‘collaborate’ for 6 months. Give them a 30-day download, then get out of the room. As we discuss in escaping founder-led sales, your presence in the meeting undermines their authority. If the team looks at you for the final ‘yes,’ you haven't delegated anything.

This is the hardest part. As a founder, ‘work’ feels like tangible output—emails sent, code committed. As a CEO, ‘work’ is thinking, recruiting, and alignment. You will feel lazy. You will feel unproductive. Ignore that feeling. It is the ghost of your former identity trying to drag you back into the weeds.

The choice is binary: You can be the hero of a $10M company, or the architect of a $100M company. You cannot be both.