For the better part of a decade, the "Rule of 40" was a polite suggestion—a slide in a board deck that everyone nodded at before approving a plan that burned cash to fuel 60% growth. As long as topline revenue was climbing, the multiple would take care of itself. That era is dead.

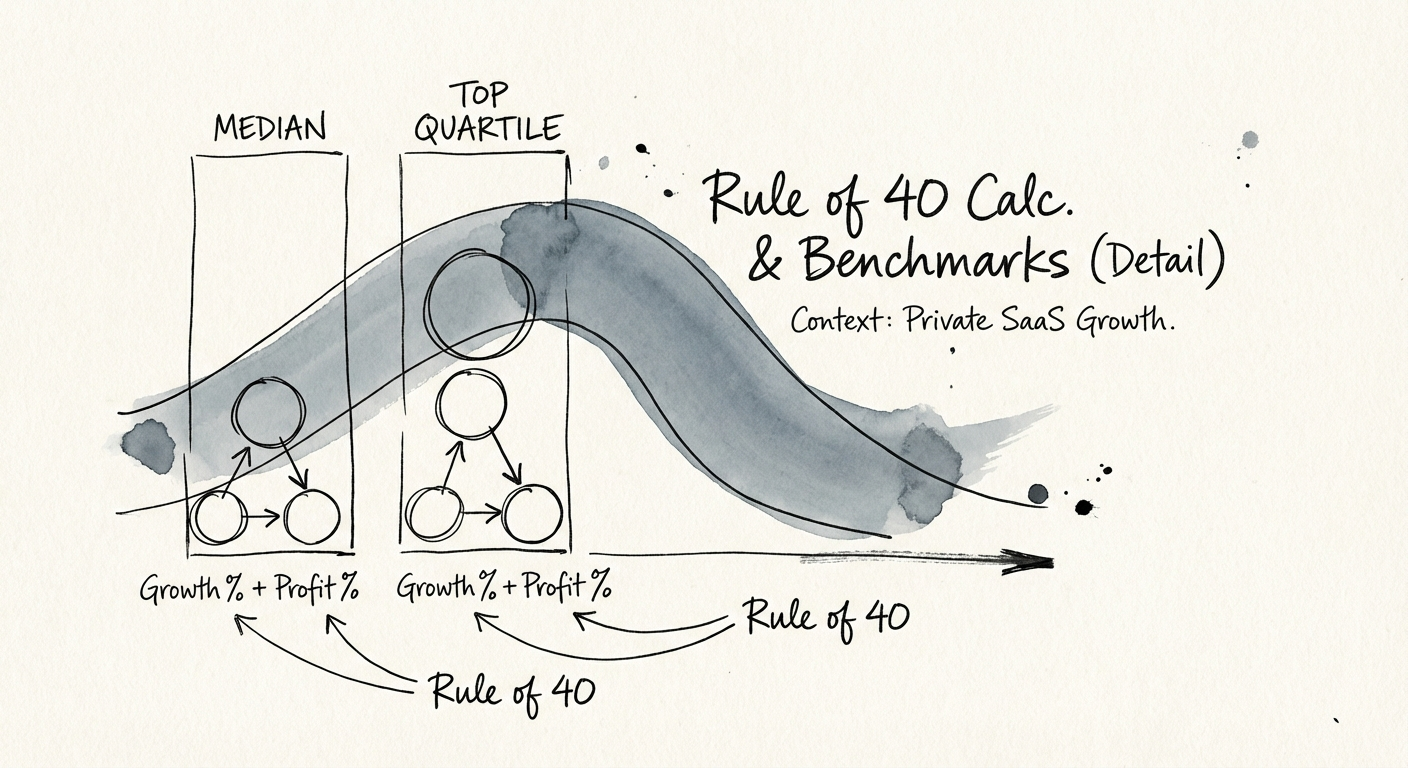

Today, the median private SaaS company isn't hitting 40%. It isn't even hitting 20%. According to Q1 2025 data from CloudZero and KeyBanc, the median Rule of 40 score for private B2B SaaS companies sits at a meager 12%. This creates a massive bifurcation in the market:

For Private Equity Operating Partners, this 12% benchmark represents a crisis of operational discipline. You likely have portfolio companies that are growing at 15% but running at breakeven (Rule of 15), or growing at 30% while burning 20% (Rule of 10). In the current exit environment, these assets are illiquid. Strategic acquirers and secondary markets are no longer paying for "growth at any cost." They are paying for Efficient Growth.

While venture capitalists might accept Free Cash Flow (FCF) in the calculation, the Private Equity standard is stricter. We measure Rule of 40 as:

Rule of 40 = ARR Growth % + EBITDA Margin %

We use EBITDA because it is the proxy for the debt serviceability and operational leverage you need for a recapitalization or exit. If your portfolio company is relying on adjusted FCF to hit the number (by delaying payables or capitalizing software aggressively), you are masking the underlying operational inefficiency.

The gap between "good" and "great" has widened. Data from ICONIQ Growth's 2025 State of Software and KeyBanc's market surveys illustrates a stark valuation cliff based on efficiency scores.

If you are managing a Series B/C asset doing $10M-$20M ARR, a pure Rule of 40 might unfairly penalize high growth. Investors increasingly look at the Weighted Rule of 40 (sometimes called the Rule of X), calculated as:

(2 × Growth Rate %) + EBITDA Margin %

This weighting acknowledges that for companies under $50M ARR, growth is twice as valuable as profitability—provided the unit economics are sound. However, as the company crosses $50M ARR, the weighting shifts back to 1:1. You cannot outgrow bad margins forever.

See our deep dive on SaaS EBITDA Benchmarks by ARR Band to understand how your portfolio's margin profile should evolve as it scales from $10M to $50M.

If your portfolio company is sitting at a Rule of 12, simply "cutting costs" is a blunt instrument that often kills growth. You need a surgical approach to Unit Economics. Here is the operator's playbook for correcting the ratio:

Most founder-led firms haven't raised prices in 3 years. A 10% price increase drops directly to the bottom line, immediately improving your Rule of 40 score by increasing both the numerator (Growth) and the denominator (Margin). It is the single most efficient lever available.

Stop treating Implementation and Customer Success as "Marketing expenses." If your Gross Margins are below 75% for pure SaaS, you have a delivery problem. Move non-recurring engineering and low-margin professional services below the line or automate them. High COGS are the silent killer of the Rule of 40.

You cannot cut your way to growth, but you can stop buying bad revenue. If your CAC Payback is over 18 months, your growth is toxic. It degrades your EBITDA faster than it adds ARR. Cut the bottom 20% of performing reps and redirect that spend toward channels with proven LTV/CAC ratios.

Finally, look at General & Administrative (G&A) bloat. Is the founder still playing "Chief Everything Officer"? This often leads to redundant hires to support the founder's lack of process. Documenting systems and removing key-person dependency often allows you to reduce headcount while improving velocity.

The market has spoken: Growth at all costs is over. The Rule of 40 is no longer an aspiration; it is the gatekeeper to liquidity. Whether you are prepping for a 2026 exit or stabilizing a wobble, the math is unforgiving. You are either an efficient compounder or a distressed asset. Choose accordingly.