You have just closed the deal. The investment thesis is sound, the multiple was reasonable (for 2025), and the financial engineering model shows a clear path to 3x returns. The spreadsheet says this merger is a home run. But the spreadsheet is lying to you.

The spreadsheet doesn't know that the target company's CTO has been hiding 18 months of technical debt behind a shiny frontend. It doesn't know that the \"synergies\" you modeled assume a unified sales motion that the acquired sales VP actively opposes. It doesn't capture the friction that costs acquirers an average of $200 million in lost net income when leadership styles clash.

We are seeing a resurgence in deal volume. McKinsey reports a 12% increase in global deal value for 2024, continuing into 2025. Yet, the historical failure rate remains stubborn. Research consistently shows that between 70% and 90% of M&A deals fail to achieve their projected value. More damning is why they fail. It is rarely the financial model. According to Bain & Company analysis, 83% of practitioners cite poor integration as the primary cause of deal failure.

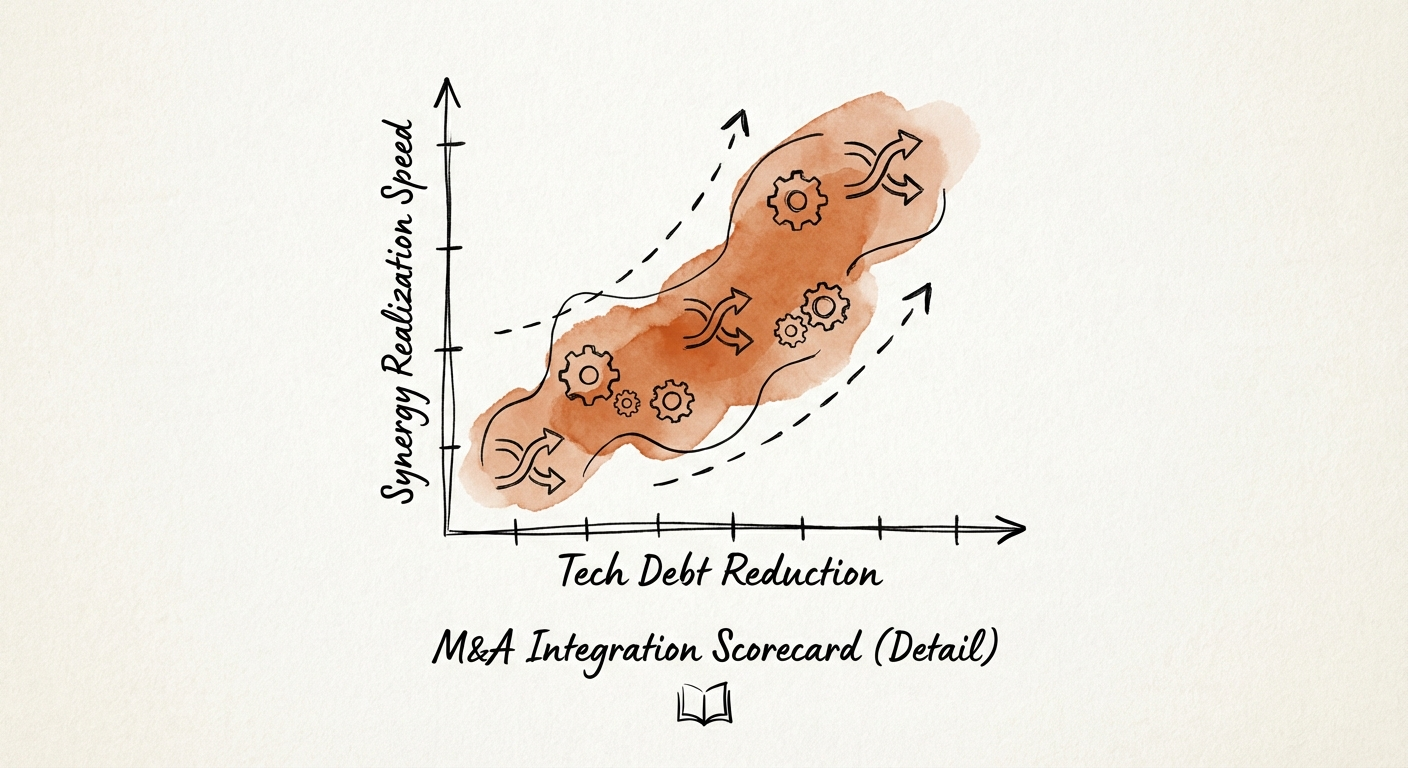

As an Operating Partner, your job isn't to re-underwrite the deal; it's to ensure the integration doesn't bleed EBITDA. You need a scorecard that measures the actual drivers of integration success: technical velocity and cultural alignment. If you are only tracking financial synergies, you are looking at a lagging indicator. By the time the revenue miss shows up in the board pack, it is already too late.

Financial metrics tell you what happened. Operational metrics tell you what will happen. To govern a portfolio company through a complex integration, you need to measure the friction points that kill synergy realization. Here is the scorecard elite Operating Partners use to quantify the \"soft\" stuff.

In high-tech mergers, McKinsey data indicates that 70% of firms fail to achieve anticipated revenue synergies. The culprit is almost always technical debt. You cannot cross-sell Product B to Product A's customers if the backend integration takes 18 months instead of six. Stop asking \"Is the integration done?\" and start measuring Remediation Velocity.

Retaining headcount is irrelevant if you lose the top 10% of performers who hold the institutional knowledge. A 2024 WTW study found that while 72% of companies use retention agreements, many fail to track retention beyond the payout period. You cannot buy loyalty with a retention bonus; you buy it with clarity.

Culture is not \"vibes\"; it is decision-making velocity. If Company A is hierarchical and Company B is autonomous, decision-making grinds to a halt. This friction is measurable. We track the Decision Cycle Time for cross-functional initiatives.

You cannot manage what you do not measure, but you also cannot measure everything. To operationalize this scorecard, you need to implement a rigorous governance cadence immediately post-close. Do not wait for the 100-day plan review; that is too late.

Deploy a rapid assessment team to map the reality on the ground against the diligence reports. Your goal is to validate the Technical Debt Velocity baseline. Interview the engineering leads, not just the CTO. Ask: \"What code are you afraid to touch?\" Their answers will give you a more accurate integration timeline than any Gantt chart. Review our framework for stack consolidation to structure this audit.

By month two, you should have enough data to re-forecast your synergies based on actual Decision Cycle Time. If decisions are taking twice as long as expected, cut your year-one synergy targets by 50% and reallocate resources to unblocking governance. This is the moment to be brutal with the board. Better to reset expectations now than to miss guidance for three consecutive quarters.

Shift from \"integration\" to \"operation.\" The separate integration management office (IMO) should begin to dissolve into the standard operating cadence. At this stage, your Talent Density Retention metric is your canary in the coal mine. If you see key engineers exiting after their first retention vest, your integration is failing, regardless of what the P&L says.

Integration is not a project; it is a transformation. The firms that win in this vintage won't be the ones with the best buy-side models—they will be the ones with the best operational execution. Speak fluent EBITDA, but execute in fluent DevOps and Culture.