If your Net Revenue Retention (NRR) is below 100%, you do not have a growth problem. You have a product or service problem disguised as a churn problem. And it is costing you millions in enterprise value.

In the current market, growth at all costs is dead. Efficiency and retention are the new kings. Yet, I see too many founders—our "Scaling Sarahs"—celebrating a record quarter of new bookings while their NRR quietly slips to 95%. They believe they can simply out-sell the churn. This is a mathematical impossibility and a strategic suicide.

When NRR drops below 100%, your business is shrinking by default every January 1st. You start the year in a hole, forced to resell your own revenue just to stay flat. This is not a scalable platform; it is a treadmill. More importantly, the market knows this. Investors punish low NRR more severely than almost any other metric.

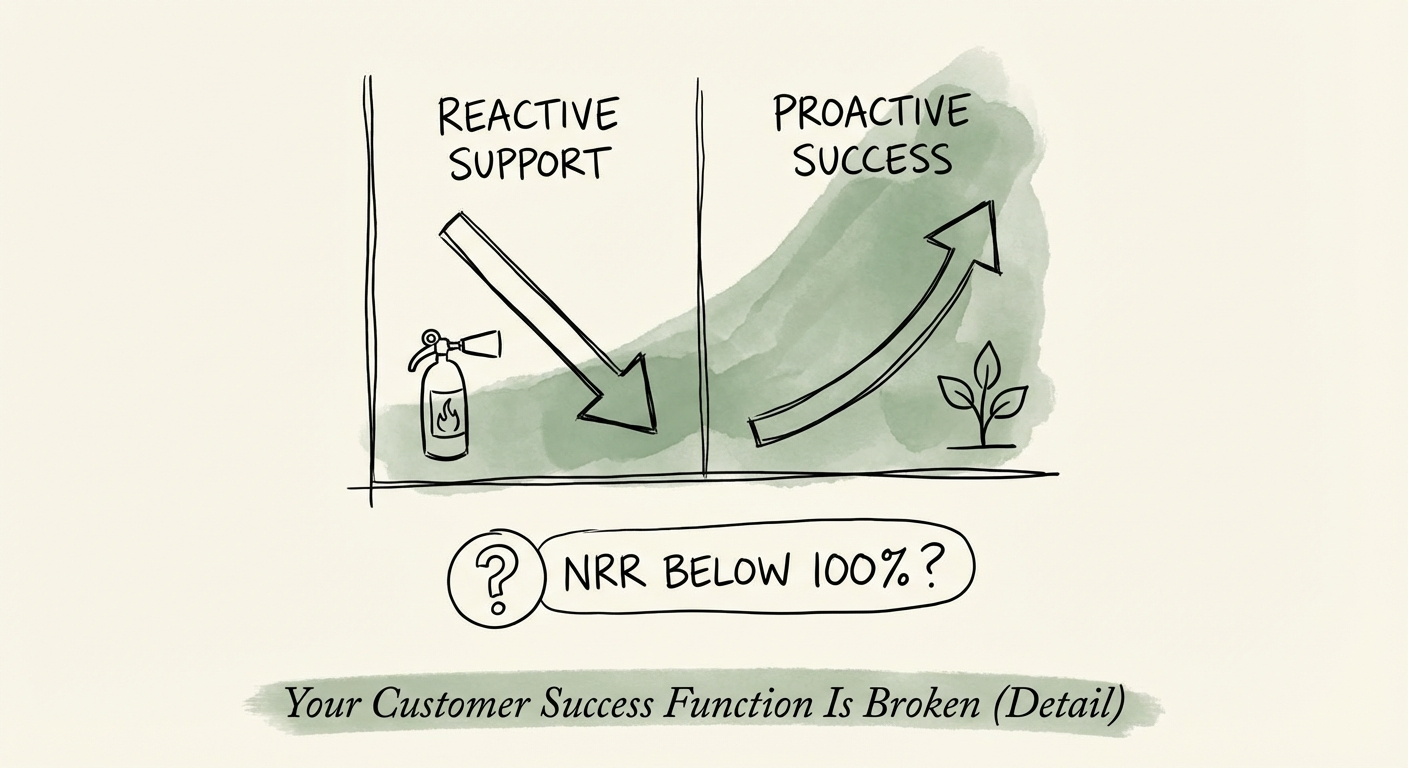

The root cause is rarely the product itself. It is almost always a category error in how the company views "Customer Success." In Founder-led organizations, Customer Success often devolves into "Heroic Support." It becomes a catch-all department for fire-fighting, bug-logging, and apologizing.

Your CSMs aren't driving value; they are absorbing pain. They are measured on "responsiveness" and "happiness," not on renewals and expansion. This is reactive, it is unscalable, and it destroys NRR.

Let’s look at the hard data. The difference between top-tier retention and median retention is not just a rounding error; it is the difference between a lucrative exit and a distressed asset sale.

According to recent market data, companies with NRR above 120% command revenue multiples 2-3x higher than those with NRR below 100%. Specifically, data from the Software Equity Group shows that low-retention firms (<100% NRR) trade at a median of roughly 3.1x revenue. High-retention firms (>120% NRR) trade at 9.3x revenue. That is a 200% premium for the exact same top-line revenue number.

Think about that. Two companies, both doing $10M ARR. Company A has 95% NRR; it's worth ~$31M. Company B has 125% NRR; it's worth ~$93M. The only difference is that Company B has engineered a system to keep and grow its customers.

If you are hovering around 100%, you are falling behind. The 2025 median NRR for B2B SaaS is approximately 106%. Top-quartile performers are consistently above 120%. If you are below 100%, you are in the bottom quartile. You are effectively paying a "churn tax" on every dollar of equity value.

Furthermore, valuation data suggests that companies with >100% NRR grow twice as fast as their peers, simply because they aren't fighting the headwinds of contraction. Existing customers should generate 40-50% of your new ARR as you mature.

To break the 100% ceiling, you must stop treating Customer Success as a cost center and start treating it as a revenue engine. This requires a shift from reactive support to proactive commercial management.

You cannot treat a $100k client the same as a $5k client. One of the fastest ways to burn out your team and miss NRR targets is a flat coverage model. You need rigorous segmentation:

Stop doing "check-in" calls. If your CSMs are asking "How are things going?", they are failing. A Quarterly Business Review (QBR) must be a commercial conversation. It should answer one question: "What is the ROI you achieved with our platform in the last 90 days?" If you can't prove ROI, you haven't earned the renewal, let alone the upsell.

If your CSMs are only compensated on "retention" (keeping the lights on), you will get flat NRR. To drive NRR >100%, you must incentivize expansion. Give your CSMs a quota for cross-sells and upsells. Make them hunters within the farm. This aligns their incentives with LTV maximization, not just churn prevention.

NRR is the ultimate health score of your business model. Fixing it is not about hiring nicer people; it is about building a stricter system. Move from Heroics to Engineering, and watch your valuation multiple expand along with your revenue.