You didn’t buy the code repository. You didn’t buy the customer list. In a modern tech-enabled services firm, you bought the 50 brains that know how to stitch those two things together to print EBITDA. Yet, the standard Private Equity playbook for Day 1 integration often treats human capital as a fixed asset—until it walks out the door.

The data is brutal. 33% of key employees leave within the first 12 months of an acquisition. If you are modeling a 3x return based on continued growth, losing a third of your delivery capacity in Year 1 is not a "headwind"; it’s a thesis killer. When a Senior Architect or VP of Sales leaves post-close, you aren’t just losing a headcount. You are incurring a replacement cost estimated at 1.5x to 2x their annual compensation, plus a 4-6 month productivity lag for the new hire.

Most Operating Partners attempt to solve this with "Golden Handcuffs"—cash retention bonuses vesting over 18-24 months. While WTW data shows 80% of firms use these, cash alone is a Band-Aid on a bullet wound. If the acquired CTO feels their decision-making authority has been stripped by your central committee, no amount of deferred cash will keep them engaged. They will vest and rest, or worse, toxic-vest: stay on payroll while poisoning the culture for the junior staff.

We need to move beyond financial engineering and start practicing Operational Engineering for talent. The goal isn't just retention; it's engagement. You need the acquired team to run harder towards the next exit, not wait out their sentence.

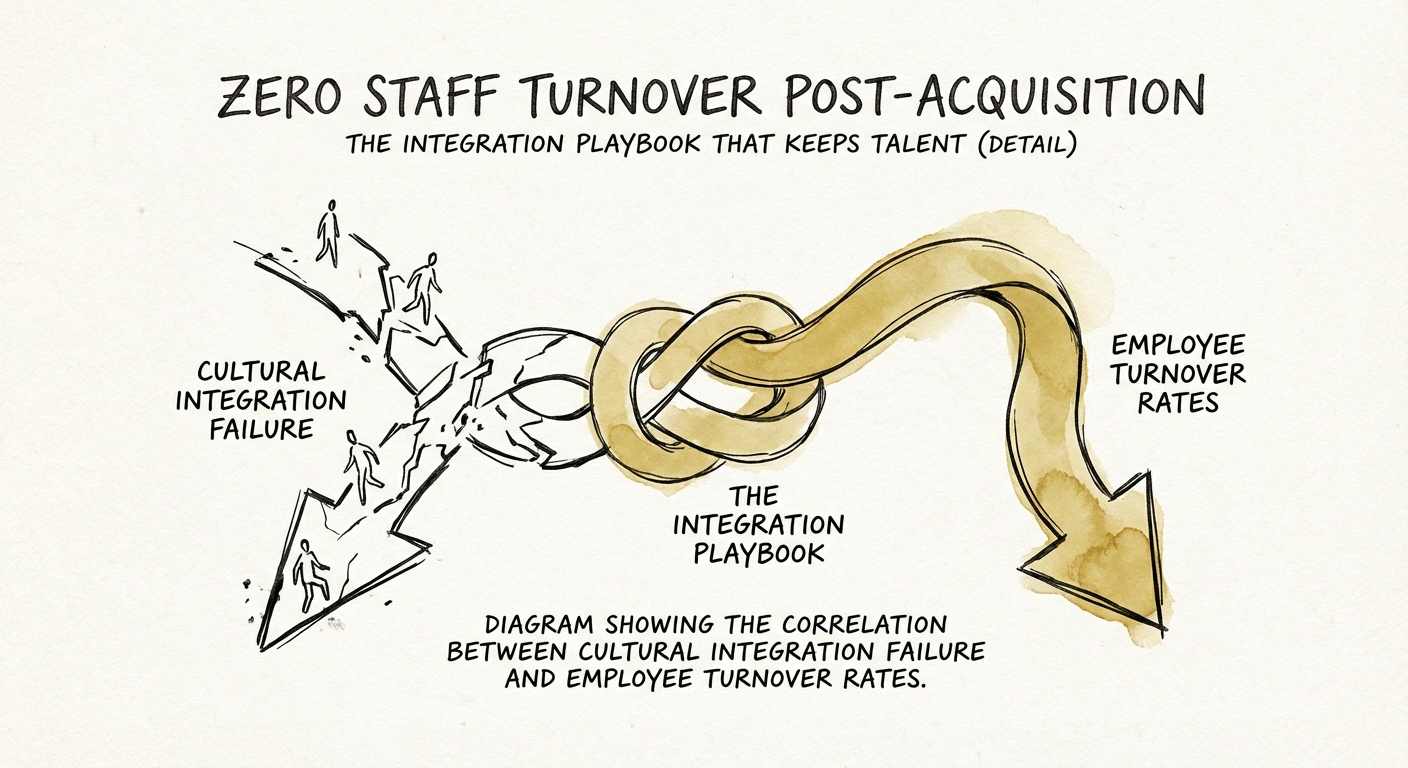

Stop treating culture as "soft." In the context of M&A, culture is simply how decisions get made and how work gets done. When deals fail—and 70-90% of them do fail to meet objectives—it is rarely because the financial model was wrong. It is because the integration strategy ignored the "Tribal Knowledge" that held the target company together.

Uncertainty breeds attrition. On Day 1, high-performers are updating their LinkedIn profiles because they assume "synergies" means "layoffs." You must announce a specific "Safe Harbor" period—typically 6 months—where no operational roles will be cut. This buys you trust. If you need to right-size, look at optimizing engineering ratios later, but stabilize the ship first.

The #1 frustration for acquired leaders is the sudden loss of autonomy. They used to buy software with a credit card; now they need three approvals. Implement a clear Decision Rights Matrix (RAPID or RACI) in Week 1. Clarify exactly what they can still decide (e.g., hiring junior devs, sprint prioritization) and what now requires Board approval (e.g., CAPEX >$10k). Ambiguity here feels like demotion.

Don't wait for the resignation letter. Between Day 30 and Day 60, conduct structured "Stay Interviews" with the top 20% of talent. These are not performance reviews. They are discovery sessions asking: "What is the one thing that would make you leave this year?" and "What is the one process broken by this acquisition?" You will uncover revenue-impacting friction points—like a broken CRM integration or a stalled customer retention process—that you can fix immediately to score quick wins.

To achieve zero unwanted turnover, you need a rigorous cadence of communication and alignment. This is not about "HR updates"; it is about connecting their daily work to the new enterprise value.

According to Revelio Labs, post-acquisition attrition spikes specifically in high-paying roles. These are the people driving your alpha. You can buy companies, but you have to earn the team. By deploying this operational framework, you convert the anxiety of acquisition into the energy of a turnaround. You stop the bleeding, you stabilize the asset, and you keep the only machinery that actually generates returns: the people.