If you feel like you are working harder than ever for diminishing returns, the data confirms you are right. In 2025, the median professional services firm is no longer a cash cow; it is a tired workhorse. According to the 2025 Professional Services Maturity Benchmark by SPI Research, average EBITDA margins across the industry have plummeted to 9.8%—the lowest level in five years. Even more alarming, this drop occurred while deal pipelines actually grew by 8%.

This is the "Median Trap." You are selling more work, but you are keeping less of it. The culprit isn't a lack of sales; it is broken unit economics.

For founders like you—who built the company on "hero heroics" and client obsession—this is a painful realization. You have likely been told that growth solves everything. "Just add another $5M in revenue," the advisors say, "and the margins will follow." The data proves them wrong. Revenue growth has slowed to 4.6%, and without a fundamental restructure of your delivery economics, adding revenue to a 9.8% EBITDA business just creates a bigger, lower-margin headache.

The difference between a stressed founder taking home 10% and an exit-ready operator taking home 22% isn't magic. It is engineering. It is the discipline to refuse "empty calories" revenue and the rigor to plug the operational leaks that are draining your profit pool.

How do elite firms deliver 25%+ margins while you struggle to break 10%? They don't just charge more (though they often do); they operate differently. To bridge the gap from 9.8% to 22%, we must look at the physics of your P&L. Specifically, we need to fix three critical leaks that are verified by 2025 industry benchmarks.

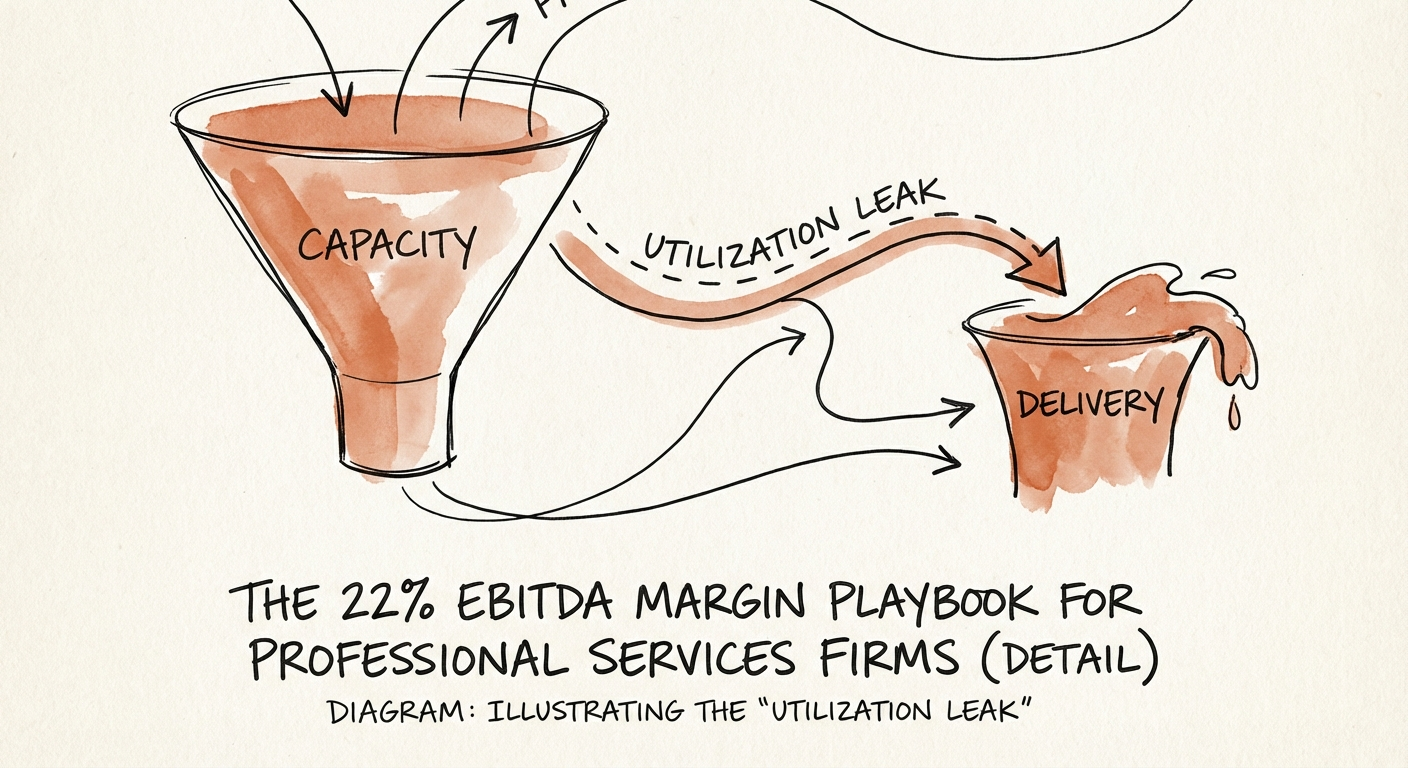

The single biggest killer of services margin is the gap between capacity and billability. SPI Research data shows that average billable utilization has fallen to 68.9%, well below the industry standard target of 75%. That 6.1% gap isn't just lost time; it is pure profit evaporation. In a 50-person firm, that gap represents roughly $1.5M in lost annual EBITDA. You are paying for the inventory (talent) but flushing it down the drain.

When projects drag, margins die. On-time project delivery rates have slipped to 73.4%. Every week a project extends beyond its scope without a change order is a week of 0% gross margin. This is often a governance failure, not a delivery failure. You likely lack the cross-functional alignment to enforce scope limits with clients.

Are you still billing time and materials? TSIA's 2025 State of Professional Services report indicates that while average hourly rates have climbed ~7%, costs have risen faster. Elite firms are decoupling revenue from hours by moving to outcome-based pricing or flat-fee structures with strict scope gates. McKinsey research has long held that a 1% improvement in price realization can yield an 11% improvement in operating profit. You don't need to double your rates; you just need to stop discounting your expertise.

You cannot wish your way to 22%. You must engineer your way there. Here is the 90-day execution plan for the Scaling Sarah persona who is done with the "profitless growth" treadmill.

Stop looking at blended margins. Break down your Gross Margin by Project and by Role. You will likely find that 20% of your projects are generating 150% of your profits, while the bottom 30% are underwater. Fire the bottom 10% of clients or re-price them immediately. As detailed in our guide on revenue leakage, the "bad revenue" you are clinging to is blocking you from taking on profitable work.

Implement a weekly "Flash Forecast" meeting between Sales and Delivery. No more "throwing projects over the fence." Sales must forecast skills needed, not just dollars booked. Use the billable utilization targets to hold delivery leaders accountable. If utilization dips below 75%, hiring freezes. If it tops 85%, you open reqs. This discipline prevents the "bench bloat" that kills EBITDA.

Institute a "Zero-Scope-Creep" policy. Empower your Project Managers to issue Change Orders (COs) the moment a client request steps outside the SOW. Make "Change Order Value" a KPI for your PMs. It sounds harsh, but clients respect boundaries. If you don't value your scope, they won't value your work.

Moving from 9.8% to 22% EBITDA doesn't require a miracle. It requires stopping the heroics. It requires systems that protect your margins from your own desire to say "yes." The market is telling you that the old way is broken. It's time to build a firm that pays you for your value, not just your effort.