You hit your bookings number last quarter. The sales team celebrated. The board nodded approvingly at the top-line growth. But you, the operator, know the dirty secret hiding in the P&L: your Net Revenue Retention (NRR) is dragging your valuation into the gutter.

For Series B and C founders (Scaling Sarahs), the "growth at all costs" era is dead. Today, efficient growth is the only currency that matters. If you are adding $2M in new ARR annually but churning $1M, you aren't a high-growth SaaS company; you are a hamster on a wheel. Investors in 2025 aren't just looking at ARR; they are scrutinizing the quality of that revenue. They want to know if your bucket has holes.

The difference between a 4x revenue multiple and an 8x multiple is often strictly defined by retention. Data from 2025 shows that for every 1% increase in Net Revenue Retention, your company's valuation increases by approximately 18% over a five-year period. Conversely, if your churn is "average," you are likely bleeding equity value every single month. It is time to stop treating Customer Success as a "happiness" function and start treating it as your most critical revenue engine. Stop buying growth that you can't keep.

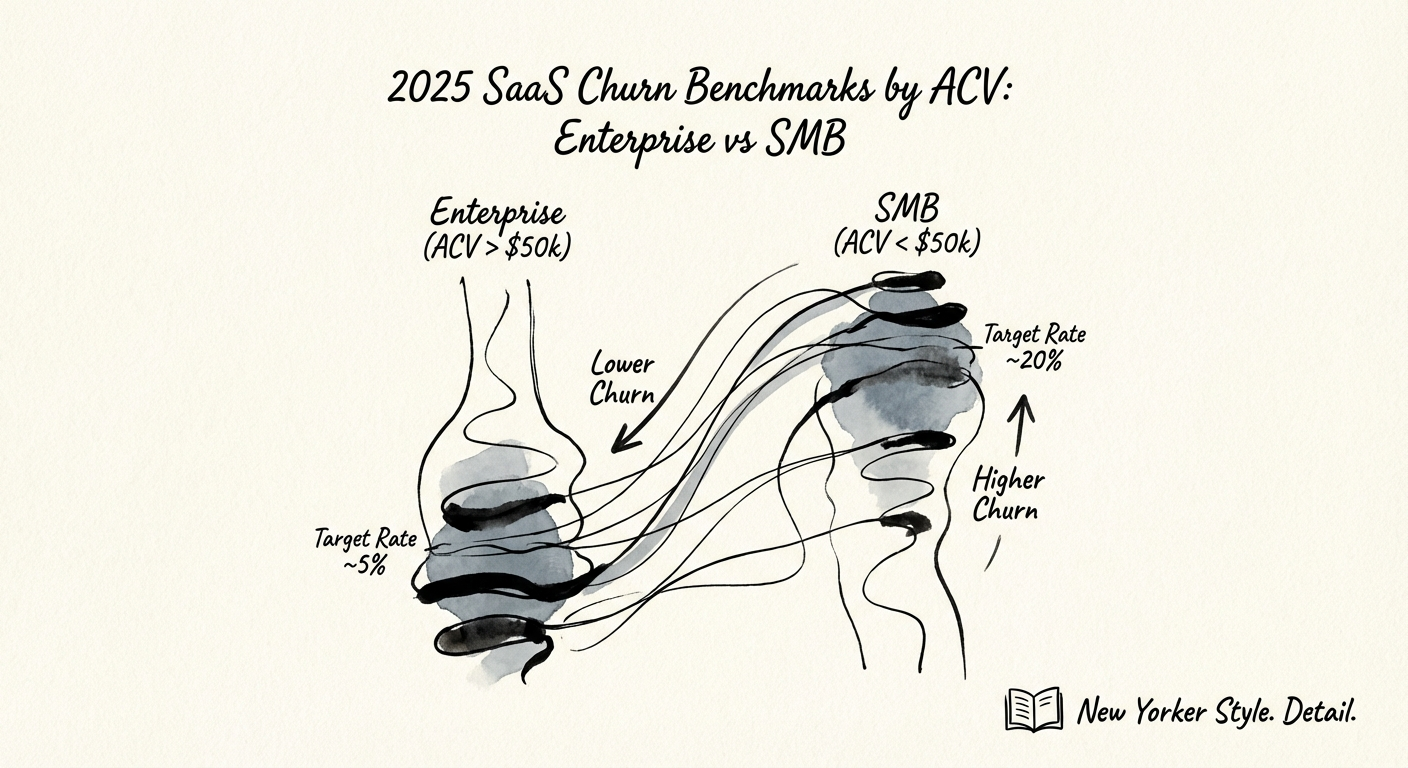

Stop comparing yourself to generic "industry averages." A 5% annual churn rate is excellent for an SMB product but catastrophic for an enterprise platform. To diagnose your health, you must segment by Average Contract Value (ACV) and customer size.

According to 2025 data from SaaS Capital and Agile Growth Labs, acceptable churn rates vary wildly based on who you sell to:

Gross churn tells you who left; Net Revenue Retention (NRR) tells you if you are building a sustainable business. The median NRR for B2B SaaS in 2025 sits at 106%. This means the average company grows slightly from its existing base. However, the top decile—the firms commanding premium exits—are consistently hitting 120%+ NRR.

If your NRR is below 100%, you are in a "melting ice cube" scenario. You are fighting a mathematical headwind that gets stronger as you scale. Referencing our guide on SaaS EBITDA benchmarks, you'll see that firms with <100% NRR rarely achieve the Rule of 40.

Vertical matters. In 2025, EdTech is seeing monthly churn as high as 9.6% due to budget constraints, while FinTech holds steady with strong retention (annual churn ~12%) due to high switching friction. If you are in a volatile vertical, your "safe" benchmark might be an illusion.

You cannot "heroic effort" your way out of a churn problem. You need systems. If your churn is above benchmark, execute this diagnostic immediately.

About 20-40% of churn in lower ACV models is involuntary—failed credit cards and billing errors. This is purely an operational failure. Implement dunning management tools and account updaters immediately. Recovering 1% of revenue here is pure EBITDA.

Stop doing "check-in" calls. Your Customer Success Managers (CSMs) must pivot to commercial conversations. Every interaction should confirm value delivery against the initial business case. If your CSM doesn't know the ROI the client is getting, the client doesn't know either—and they will churn.

If you pay your AEs 100% commission on deals that churn in 90 days, you are paying them to kill your company. Implement clawbacks for early churn (under 6 months) and consider accelerators for multi-year contracts paid upfront. Align the hunter's incentive with the farmer's reality. Revenue leakage often starts at the contract signature.

Churn is not a customer service problem; it is a company strategy problem. High churn means you are either selling to the wrong people, or your product isn't delivering the promised value. Fix the bucket before you turn up the hose. In this market, retention is the new growth.