The era of "buy low, leverage high, sell fast" is statistically dead. According to Bain's mid-year 2025 data, the median holding period for US exits has crept up to nearly six years. For Operating Partners, this shift exposes a dangerous vulnerability in the portfolio: the "drift" phase.

You likely have at least two companies in your portfolio right now that are drifting. They aren't distressed enough to trigger a full crisis response, but they are consistently missing the growth figures required to justify their entry multiple. In previous cycles, you might have relied on multiple expansion to cover these operational sins. Today, that tailwind is gone. Market data indicates that multiple expansion, which used to drive over 40% of value creation in software deals, has effectively collapsed as a primary lever.

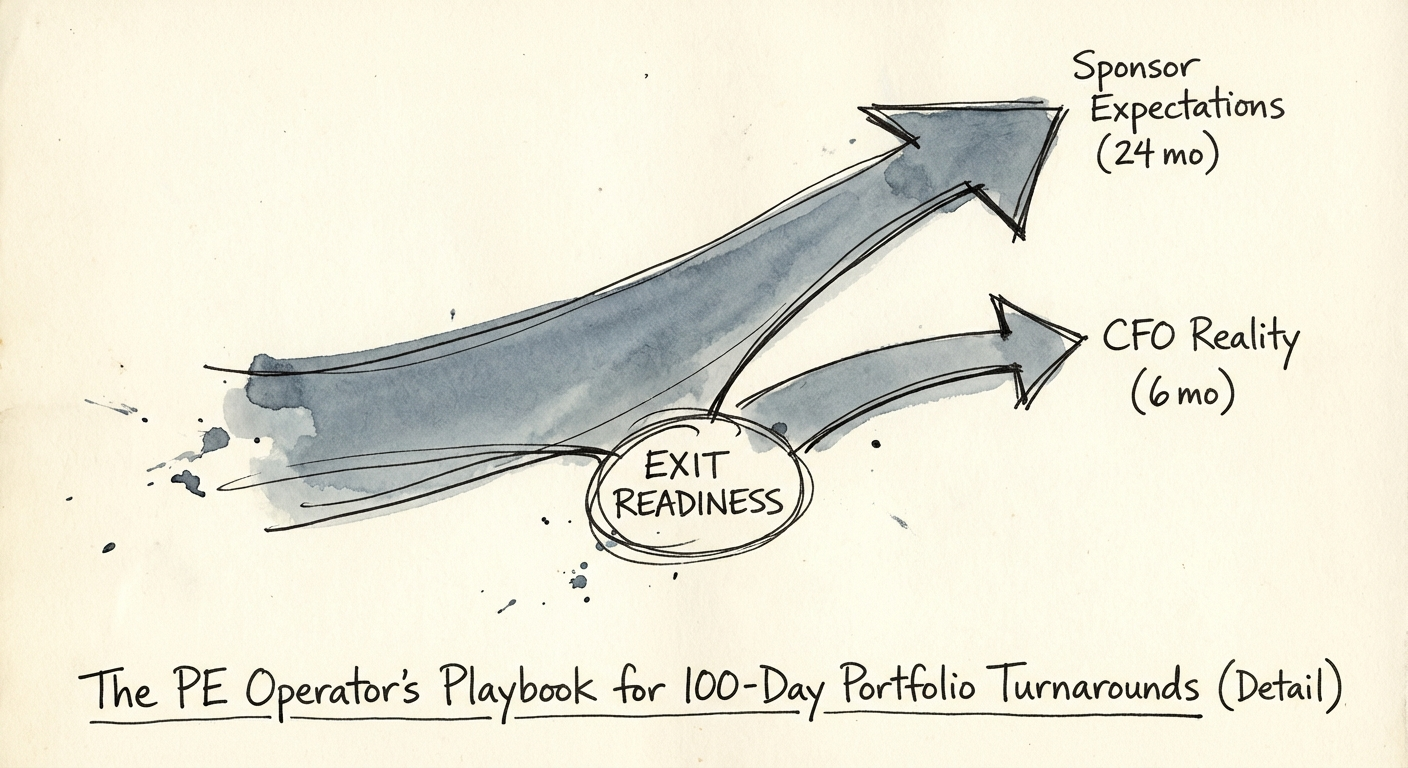

The problem is the "Exit Readiness Gap." A 2025 EY study reveals a critical disconnect: while 81% of sponsors want exit preparation to begin 12–24 months before a sale, most CFOs and management teams only shift into "exit mode" 3–6 months out. This delay is fatal to valuation. By the time you realize the data isn't granular enough or the technical debt is too high, you are already in the diligence window, forcing you to sell apologies instead of growth.

The 100-day turnaround is no longer just for distressed assets teetering on bankruptcy. It is the mandatory intervention for stalled assets to bridge the gap between mediocre performance and maximum exit value. You need a diagnostic framework that cuts through the noise and identifies the EBITDA bleed immediately.

Traditional turnarounds fail because they focus on financial engineering (cost cutting) without addressing the structural breakage (technical and operational debt). To achieve a meaningful turnaround—one that McKinsey data suggests can deliver a 500 basis point (5%) EBITDA margin improvement in the first year—you must deploy Operational Engineering.

Your first move is not to fire the sales VP; it is to establish truth. Most stalled companies suffer from "Green Watermelon" reporting: green on the outside (board slides), deep red on the inside. You need a non-technical audit of the engineering and operations health immediately.

Once you have visibility, execute the "No Regret" moves. AlixPartners identifies this phase as critical for funding the longer-term transformation. You are looking for self-funding mechanisms.

The final phase of the 100-day sprint is about ensuring the changes stick. This is where you move from "fixing" to "building." Buyers in 2026 are sophisticated; they scrutinize the durability of your margins. A sudden EBITDA spike caused solely by firing support staff will be discounted during Quality of Earnings (QoE) diligence.

You cannot scale a platform built on spaghetti code. While you can't rewrite the stack in 30 days, you can ring-fence the toxic assets. Identify the "monolith" components that are slowing down feature release cycles and create a containment plan. This shows future buyers that you have a roadmap, reducing the "technical discount" on your exit multiple.

By Day 100, your portfolio company should have transitioned from "Founders Heroics" to "Systematic Growth." You should have:

The market penalties for delay are severe. Every quarter you allow a portfolio company to drift is a quarter of IRR degradation that you cannot recover. The 100-day turnaround is your primary weapon to arrest value erosion. Do not wait for the bank covenant breach to act. Treat flat growth as the crisis it is, and deploy the playbook today.