You have built a successful company. Revenue is growing, customers are happy, and the product works. But if you were hit by a bus tomorrow, would the business survive? For most founders in the $10M–$50M revenue range, the honest answer is "no." This is the Hero Trap: a business that relies on the brilliance, memory, and sheer force of will of its founder to function.

When private equity firms or strategic acquirers look at your business, they aren't just buying your revenue stream; they are buying your engine. If that engine requires you to manually crank it every morning, it is not an asset—it is a job. And nobody pays a premium for a job.

The data on this is brutal. According to Harvard Business Review, between 70% and 90% of M&A deals fail to achieve their projected value. A massive driver of this failure is operational immaturity discovered during due diligence. When a buyer peels back the layers and finds that your "proprietary process" is actually just "Steve in Operations knowing what to do," the deal typically faces one of two fates: a massive valuation haircut (often 30-50%) or a complete collapse.

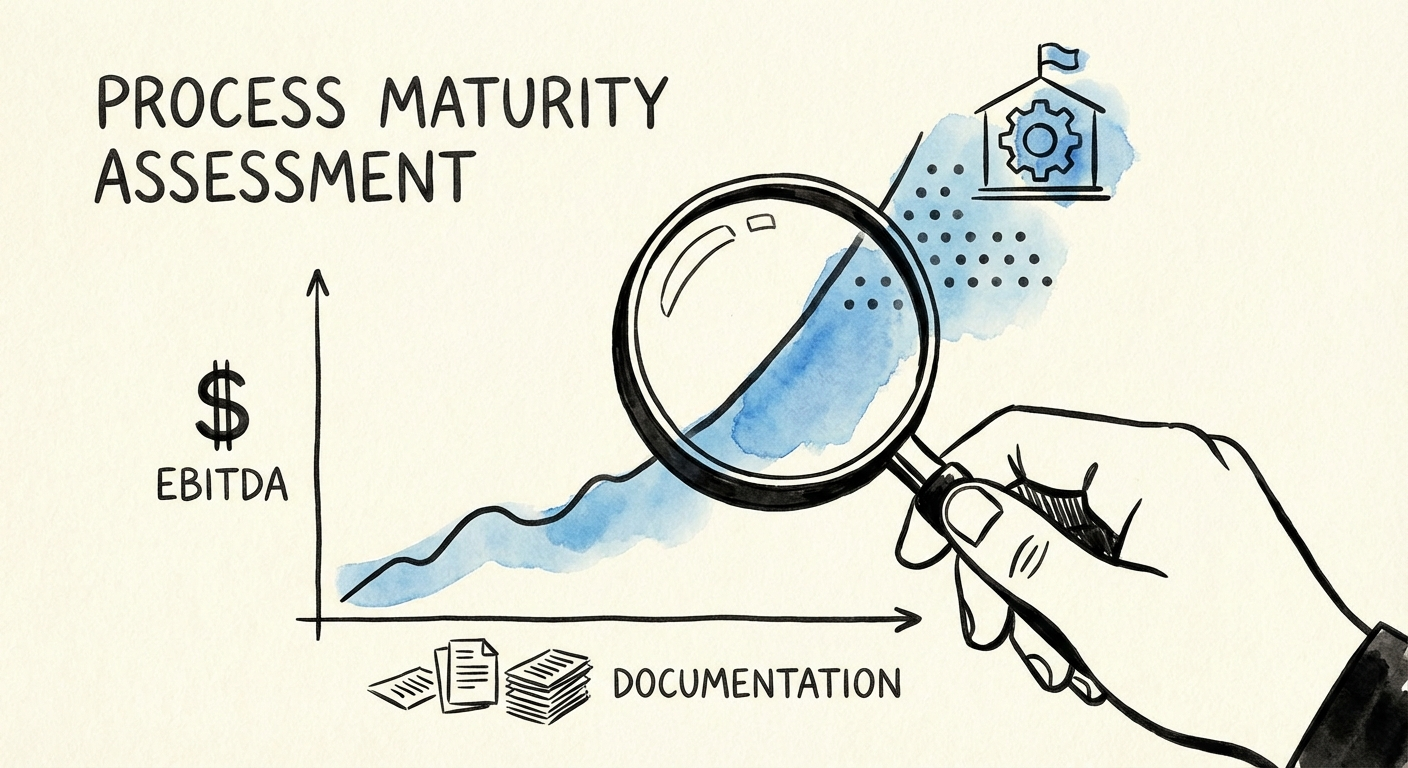

We call this the Transferability Gap. It is the difference between what your business is worth with you running it (Tribal Knowledge) versus what it is worth when anyone can run it (Institutional Knowledge). Closing this gap is the single highest-ROI activity a founder can undertake in the 24 months before an exit.

To maximize your exit multiple, you must move your operations from "Heroics" to "Optimized." We use a 5-level maturity model adapted from CMMI (Capability Maturity Model Integration) specifically for mid-market exits. Where does your firm land?

Processes are ad-hoc and chaotic. Success depends entirely on individual competence and "heroic" effort. If a key employee leaves, the capability leaves with them.

Valuation Impact: Discounted. Buyers see this as "Key Person Risk."

The team knows what to do because they've "always done it this way," but nothing is written down. Training is done by osmosis (shadowing). Consistency varies by employee.

Valuation Impact: Market Average. You might sell, but you'll be locked into a painful 3-year earnout to ensure knowledge transfer.

Standard Operating Procedures (SOPs) exist for all critical functions. Checklists are used. Onboarding is structured. You have moved from "people-dependent" to "process-dependent."

Valuation Impact: Premium. This is where the Transferability Premium kicks in.

Processes are not just documented; they are measured. You have KPIs for process adherence and output quality. Management uses data, not gut feel, to intervene.

Valuation Impact: High Premium. Buyers pay for predictability.

Processes are automated and self-correcting. Continuous improvement is culturally ingrained. The business gets more efficient every quarter without founder intervention.

Valuation Impact: Maximum Multiple (often 10x+ EBITDA).

The financial incentives to move up this ladder are concrete. Data from OPEXEngine suggests that SaaS companies successfully exiting often improve their EBITDA margins by over 20 percentage points in the 1-2 years leading up to a transaction. This isn't just about cost-cutting; it's about the efficiency gains that come from operational maturity.

You cannot fix everything overnight. The goal is not to reach Level 5 across the board—that takes years. The goal is to get your critical value-creation processes to Level 3 (Documented) before you sign a Letter of Intent (LOI).

List your top 5 revenue-generating or risk-mitigating functions (e.g., Sales Handoff, Server Deployment, Month-End Close). Assign a maturity score (1-5) to each. Be honest. If the Founder is the only one who can approve a deploy, that is Level 1.

Focus on the processes that buyers scrutinize most: Customer Acquisition (Can you sell without the founder?) and Service Delivery (Can you scale without linear headcount growth?). Use our Founder Extraction Playbook to systematically remove yourself from these loops.

Don't write 50-page manuals nobody reads. Record a Loom or Zoom video of the process being done perfectly. Transcribe it using AI. Turn that into a checklist. This moves you from Level 2 to Level 3 in hours, not months. This simple act of documenting is what allows you to move from tribal knowledge to turnkey assets.

Operational maturity is not administrative busywork; it is financial engineering. By moving your core processes from Level 2 to Level 3, you are converting "goodwill" (which is intangible and risky) into "intellectual property" (which is tangible and valuable). Start scoring your operations today. Your future exit multiple depends on it.