You have stress-tested the revenue model. You have audited the code quality. You have analyzed customer concentration risk down to the decimal point. Yet, the single biggest variable in your value creation plan—the human beings tasked with executing it—is often assessed over a steak dinner and a 'gut check.'

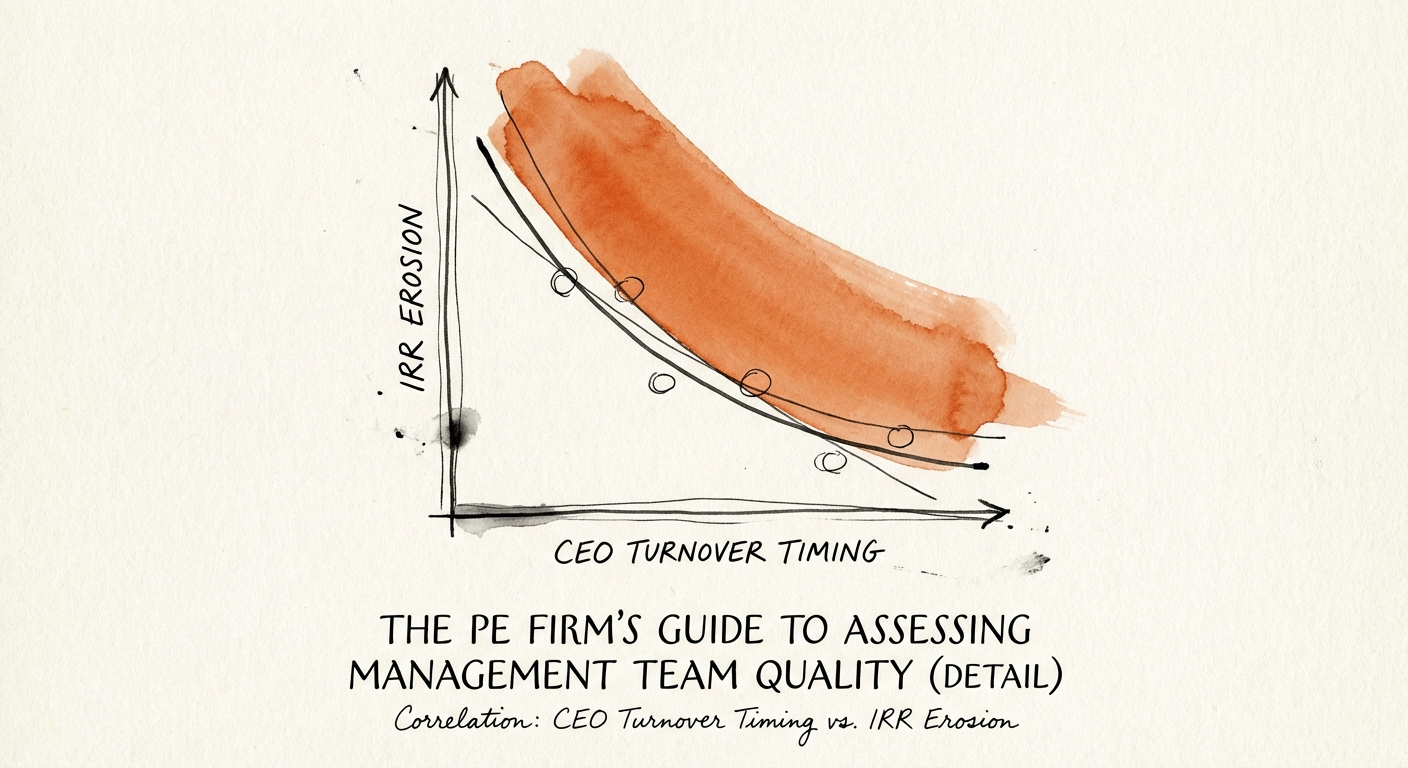

This is the Spreadsheet Fallacy: the belief that a mathematically sound value creation plan will execute itself, regardless of who is in the driver's seat. The data suggests otherwise. According to AlixPartners, 73% of portfolio company CEOs are replaced during the investment lifecycle, with 58% of those replacements occurring within the first two years. This is not just an operational headache; it is an equity killer. Unplanned CEO turnover extends holding periods by an average of 6 to 12 months and erodes IRR in nearly half of all cases.

If you are an Operating Partner managing 5-10 portfolio companies, you do not have time for 'wait and see.' The traditional approach to management assessment—relying on resume pedigree and charisma—is failing. We are seeing a massive disconnect in perception: 41% of PE executives cite senior leadership quality as a top concern, while only 13% of portfolio company leaders believe they are the problem. This gap is where your multiple compression begins.

The most dangerous CEO in your portfolio isn't the incompetent one—it's the 'good enough' founder who built the company to $10M but lacks the operational velocity to get it to $50M. They are well-liked, they know the product, and they have 'potential.' But in Private Equity, potential without velocity is just expensive waiting.

When you acquire a founder-led asset, you are buying a company built on heroics. Your investment thesis, however, relies on systems. The skills required to clear the jungle (founding) are diametrically opposed to the skills required to pave the roads (scaling). Failing to diagnose this mismatch during due diligence is why 70% of value creation plans fail to hit their year-one targets.

Stop asking "Do I like them?" and start asking "Can they scale?" To assess management quality with the same rigor as you assess financials, you need a structured diagnostic framework. This is not about personality tests; it is about Operational Velocity.

Every executive team has a 'gravity.' Some teams gravitate toward product innovation (Builders), while others gravitate toward process optimization (Scalers). You need to know which one you are buying. A team of Builders will struggle to implement the Founder-to-CEO transition required for predictable revenue. Conversely, a team of Scalers might suffocate the innovation culture that made the company valuable in the first place.

A B-player CEO hires C-player VPs. An A-player CEO hires A+ VPs. One of the fastest ways to assess a CEO's quality is to audit their last three executive hires. Did they hire someone who has already done what you need to do (e.g., took a company from $20M to $50M), or did they hire a friend/former colleague who is 'loyal'? Loyalty does not scale; competency does.

We have found that the real cost of bad hires isn't just the recruiter fee—it is the 6-9 months of stalled momentum. If the CEO cannot attract talent better than themselves, they are the lid on the company's growth.

Most PE firms outsource technical diligence to a third party who delivers a 100-page report on code quality. But code is just the output of the team. You need to assess the Engineering Management. Does the CTO speak in terms of 'refactoring' (technical output) or 'feature velocity' (business outcome)?

A CTO who cannot articulate how technical debt impacts EBITDA is a liability. You need technical leaders who understand that engineering health is a financial metric. If the engineering leader is isolated from the commercial strategy, your product roadmap will inevitably decouple from your revenue goals.

Show me a CEO who tolerates dirty data in Salesforce, and I will show you a CEO who misses forecasts. The quality of a management team's data is a direct reflection of their operational discipline. During diligence, ask to see the raw pipeline data, not the sanitized board deck. If the 'Close Date' for last quarter's deals is still in the future, or if 40% of the pipeline is in 'stage 1' for 6 months, you have a management team that manages by hope, not by metrics.

The data from AlixPartners is clear: the most disruptive time to replace a CEO is 12-18 months post-close. This is the 'Death Valley' of the holding period—too late to blame the previous owners, too early to show an exit story. If your assessment scores the management team below the threshold, you must act immediately.

You cannot financial-engineer your way out of a leadership void. The 73% turnover statistic is not a force of nature; it is a failure of diligence. By rigorously assessing the 'Builder vs. Scaler' dynamic, auditing hiring accuracy, and testing data hygiene, you can predict—and prevent—the leadership failures that kill returns.

Your job as an Operating Partner is not just to buy low and sell high. It is to ensure that the hands on the wheel are capable of driving the speed you require. If you have to question whether they are up for the task, you already have your answer.