You closed the deal on Friday. The 100-day plan, drafted by a top-tier strategy firm, promises rapid synergy capture, digital transformation, and a clear path to multiple expansion. The Excel model is elegant. It assumes a linear progression of EBITDA growth.

Twelve months later, you are sitting in a board meeting, and the numbers haven't moved. The Founder-CEO is exhausted, the new CRO quit, and that \"digital transformation\" is stuck in vendor selection.

You are not alone. According to Bain's Global Private Equity Report, the contribution of margin expansion to buyout returns has collapsed. Pre-2012, margin improvement drove 29% of value creation. Post-2012? It drives just 2%.

Let that sink in. Despite billions spent on \"value creation teams\" and operating partners, the industry is failing to engineer operational efficiency. Returns are now almost entirely dependent on revenue growth (54%) and multiple expansion (32%)—factors often driven more by market tailwinds than operator skill.

The standard playbook isn't working because it ignores the messy, non-linear reality of the middle market. It relies on financial engineering when it needs operational engineering.

Why do 70% of these transformation initiatives fail to deliver ROI in year one? The data points to three structural disconnects between the Investment Committee's thesis and the portfolio company's capability.

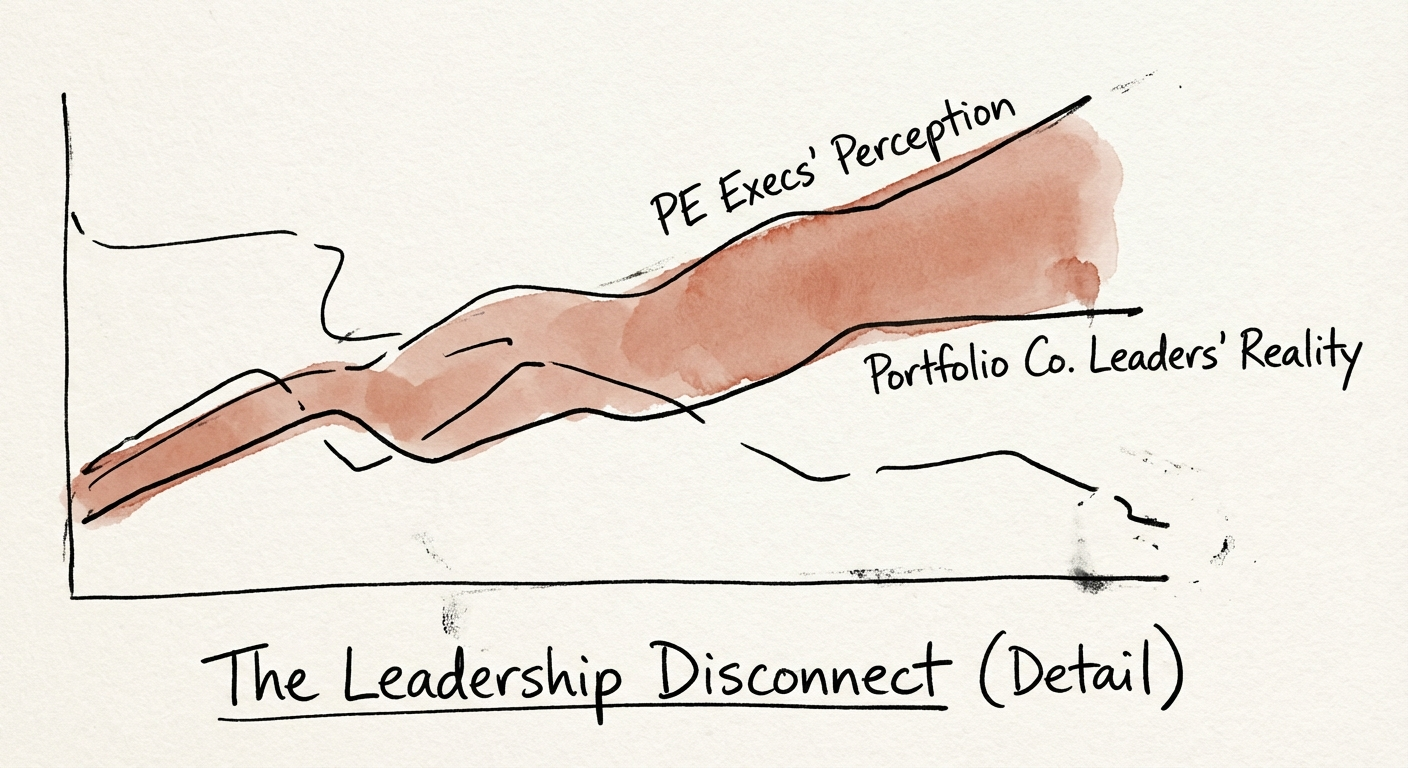

You think the management team needs support; they think they are doing fine. A 2025 AlixPartners Leadership Survey exposes a massive rift: 41% of PE executives cite the quality of portfolio company leadership as a significant challenge. Yet, only 13% of those portfolio leaders agree.

This 28-point gap is where value goes to die. If the founder believes they are a \"visionary operator\" while you see them as a bottleneck, no amount of KPI setting will fix the friction. You aren't aligned on the problem, so you can't align on the solution. This is often a symptom of founder-led dependency that wasn't scrubbed during diligence.

Every value creation plan in 2025 includes an \"AI Strategy.\" But implementation is failing. EY's 2025 Value Creation Survey found that companies are missing out on up to 40% of AI productivity gains due to talent gaps. You cannot layer advanced automation on top of broken processes and a workforce that lacks digital fluency.

The thesis was to buy a platform and bolt on acquisitions. But KPMG's 2025 findings show that median holding periods have stretched to over 6 years. Why? Because integrating those add-ons created a tangled mess of technical debt that paralyzed the organization. Instead of scaling, the company is spending 18 months refactoring code and consolidating ERPs—technical debt is financial debt, and it's eating your EBITDA.

To reverse this trend and actually capture value in the first year, Operating Partners must shift from \"advising\" to \"extracting.\"

The era of multiple expansion doing the heavy lifting is over. The 2% margin contribution stat is a warning shot. You can no longer ride the market beta. You have to build the alpha yourself.